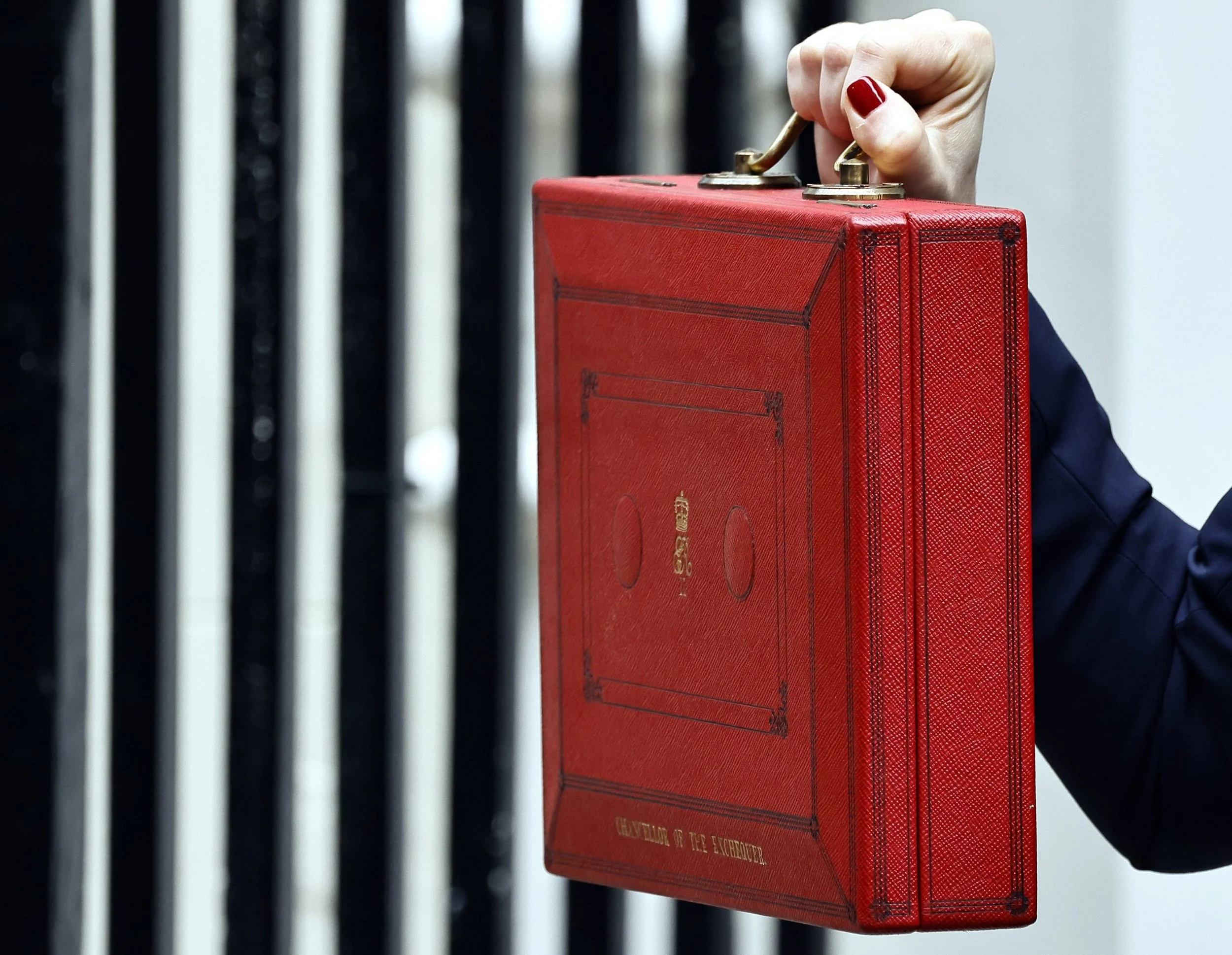

The Budget 2025

The Autumn Budget delivered today has reshaped the fiscal landscape with a clarity that can no longer be ignored. For the first time in years, the government has moved decisively on wealth, property and asset-based income, signalling a new era of higher taxation, stricter compliance, and reduced flexibility for families with significant holdings. Against a backdrop of global volatility and domestic pressure for revenue stability, the measures unveiled mark the beginning of a multi-year recalibration of how wealth is taxed, structured and transferred in the UK. For private-client families, entrepreneurs and cross-border households, the question is no longer if the rules will shift, but how quickly, and how prepared you are when they do.

With today’s Autumn Budget unveiling, many of the previously whispered reforms have now taken shape, and the next 12–18 months present a clearer (and more urgent) roadmap for private-client and family-wealth planning.

What the Government Actually Did, And What That Means

Confirmed wealth & asset tax shifts

The government will raise taxes on dividends, property income and savings income, increasing the rate by 2%, narrowing the gap between earned income and investment/asset income.

The annual Cash ISA allowance has been reduced: from £20,000 to £12,000 per year for those under 65.

For savers aged 65 and over, the full £20,000 Cash ISA allowance is preserved.

The overall structure and £20,000 total ISA limit across wrappers remains, but the “slice” available for cash has shrunk.

The government has indicated plans to publish a consultation in early 2026 on possibly updating “wrapper” rules, including reviewing certain ISA types (e.g. Lifetime ISA), to reflect shifting housing and savings policy.

The freeze on personal income tax thresholds (and by extension tax bands) has been extended further to 2030–31, a move that will bring many more into higher tax bands over time, even without nominal rate rises.

A new “High Value Council Tax Surcharge” (a kind of “mansion tax”) has been introduced, levied on properties worth over £2 million.

The “stealth tax” approach continues: threshold freezes and asset-income tax rises combine to raise the overall tax burden sharply over the medium term. According to the Office for Budget Responsibility (OBR), the tax take is projected to rise significantly by 2030–31 under this and prior budgets.

What remains – or is delayed – but spotlights still on wealth & assets

For now, the announced Budget does not change headline rates for pension-relief for high earners: pension tax relief remains as currently structured.

However, the broader squeeze on asset-related income and the freeze to thresholds substantially raises the pressure on wealth-holders: what once felt optional or distant is now highly relevant.

Structural Context: The New Baseline

The Autumn Budget tax package is estimated to raise £26 billion, marking one of the largest medium-term tax rises in modern British fiscal history.

The cumulative effect; threshold freezes, broader taxation of asset income, new richness surcharges, will:

Pull more individuals into higher tax brackets even without pay rises;

Increase the tax burden on wealth through property holdings, dividends, interest and savings;

Create additional complexity and greater need for liquidity when dealing with large estates or significant asset sales.

Why 2026 Planning Is Even More Critical Now

Given today’s Budget, the landscape for wealth-holders has already shifted. Several factors make early, proactive planning essential:

Many of the assumptions underlying traditional estate-planning strategies have changed, or will be under renewed strain.

Liquidity and flexibility matter more than ever: with property surcharges, shifting asset-income treatment and threshold freezes, static plans could leave families exposed to higher tax bills or forced asset sales.

The “safe window” to secure favourable structures, particularly for multi-generational estates, cross-border assets, property portfolios, business holdings, is narrowing fast.

Revised Strategic Recommendations: What to Do Now

If you manage significant wealth, across properties, businesses, investments, or international structures, and aspire to preserve legacy, flexibility and control, here’s what to act on immediately:

Re-audit all income-generating assets; dividends, rental income, savings interest, and model the impact of the 2 percentage-point tax rise.

Review property holdings, especially high-value homes and multi-property portfolios, the new high-value surcharge means ownership structure, valuations and intentions (hold vs sell vs pass on) need rethinking.

Revisit estate and succession plans, Wills, Letters of Wishes, trusts, to reflect the changing tax baseline.

Reassess liquidity or cash-flow plans; ensure sufficient liquid assets (or borrowing capacity) to cover potential higher tax or surcharge triggers, avoiding forced sales.

Consider timing of asset realisations or transfers; if you plan business exits, property disposals, or intergenerational gifting, now may offer a last window of relative certainty.

Check pension- and savings-structures ; though reliefs remain for now, the shifting broader context makes pensions less “safe havens” and more part of a holistic wealth review.

For international / cross-border families: scrutinise non-dom, offshore trust or investment structures, the government’s continuing drive to tax wealth and asset income may further erode their historical advantages.

Looking Ahead: What to Watch, What to Factor In

Today’s Budget sets a new baseline, but it does not mark the end of change. Over the coming months:

Expect further guidance and technical detail on the high-value property surcharge (valuation thresholds, periodic revaluations, exemptions or reliefs for trusts, couples, family offices).

Monitor how pension-taxation reforms evolve, even if outright relief cuts were avoided today, the broader fiscal pressure may push the government towards further measures.

Expect increased regulatory and compliance focus, as asset income becomes more taxed, the government may scale up audits, enforcement and transparency.

Consider the broader economic knock-on: higher taxes on asset income may shift investment behaviour, property markets, exit strategies, and family-office planning.

For Individuals

1. Asset-Based Income Tax Rise (+2%)

What changed:

Dividends, rental income and savings income are taxed 2% higher.

Example:

A client receiving £50,000 in dividends from an investment portfolio.

Before: approx. £16,250 tax

After: approx. £17,250 tax

£1,000 more tax with no change in income.

A landlord earning £40,000 in rental income sees a similar rise.

Impact:

Lower net income from investments

Pressure to reconsider portfolio structure (ISAs, pensions, offshore bonds, FICs)

More value in tax-advantaged wrappers

Reduced attractiveness of high-yield, high-tax investments

2. Income Tax Threshold Freeze Extended to 2030–31

What changed:

No increases to tax bands for five more years.

Example:

An employee earning £97,000 today gets a £5k pay rise next year.

Even though their real income is barely higher (after inflation), they may now cross into the additional rate band.

Result: higher marginal tax + more withdrawn child benefit if applicable.

Impact:

More people slide into higher brackets (“fiscal drag”)

Stealth tax on professionals, senior employees and founders

Reduction in real disposable income

Pension contributions become more valuable as a planning tool

3. New High-Value Property Surcharge (>£2m homes)

What changed:

A new annual surcharge (like a mansion tax) applied to properties valued over £2 million.

Example:

A London townhouse valued at £3.5m.

Estimated surcharge: £3k–£5k per year.

A family with two such properties (main home + investment) now faces £6k–£10k annually.

Impact:

Higher holding costs for prime property

Affects UHNW families, property investors, and second-home owners

May influence decisions on property retention, refinancing or gifting

Encourages reviewing property structures (trusts, FICs, joint ownership)

4. No Change to Pension Relief (but rising relative pressure)

What happened:

Relief remains untouched for now.

Example:

A high earner receives 45% relief on £60k of contributions.

Today, this relief is still intact, but with rising taxes elsewhere, it effectively becomes more valuable.

Impact:

Pensions remain a key shelter

Opportunity to maximise contributions while stable

Expect ongoing political pressure to reform high-earner relief

For Business Owners & Entrepreneurs

1. Dividend Tax Rise (+2%)

What changed:

Owner-managers face higher tax on dividends extracted from their companies.

Example:

A founder takes £120,000 in dividends per year.

Before: ~£39,000 tax

After: ~£41,400 tax

£2,400 extra tax annually.

Impact:

Higher cost of taking profits from the company

Rebalancing required: salary vs dividends vs pension contributions

Incentive to consider alternative remuneration models

2. Threshold Freezes Pull More into Higher Tax Brackets

What changed:

Business owners with rising profits or drawings are disproportionately affected.

Example:

A director increasing drawings from £100k to £115k triggers:

higher marginal tax

loss of personal allowance

increased exposure to the 60% effective tax band

Impact:

Owners pay more tax without rate increases

Pushing strategies such as pension contributions, profit deferral, or alternative extraction methods

3. Heightened Scrutiny of Business Reliefs (APR/BPR)

What changed:

Reliefs remain available, but the Budget signals far tighter enforcement.

Example:

A family business claiming Business Property Relief (BPR) must now provide:

detailed trading records

evidence of commercial activity

proof of non-investment nature

Failure may result in losing 100% relief previously assumed.

Impact:

Greater risk during HMRC enquiries

Need for earlier succession planning

More documentation required (board minutes, business plans, valuations)

4. Property-Holding Businesses Hit by High-Value Surcharge

What changed:

SPVs, development companies and FICs with high-value UK property face extra annual charges.

Example:

A family investment company holding three London properties (£2.8m, £3.1m, £4m).

Total surcharge exposure: £9k–£15k per year.

Impact:

Reduced returns for property portfolios

Pressure to restructure holdings

Increased importance of long-term property strategy

5. No New Incentives for Entrepreneurs (status quo = real erosion)

What changed:

No enhancements to R&D, EMI, EIS or Business Asset Disposal Relief.

Example:

A founder planning an exit in 2026 receives:

no additional CGT relief

no improved incentives for reinvestment

rising dividend tax on pre-exit profit extraction

Impact:

Reduced attractiveness of UK entrepreneurial ecosystem

Greater need for tax modelling before exits

Consideration of international structuring or phased exits

THE BUDGET 2025 CHECKLIST

FOR INDIVIDUALS

1. Re-model your dividend, rental and savings income

Why: Asset-based taxes are now 2% higher.

Action:

Recalculate expected tax on dividends, rental income and interest

Check whether your current mix of assets still delivers the net return you expect

Explore wrappers (ISAs, pensions, offshore bonds)

2. Reassess your income band for the next five years

Why: Thresholds are frozen until 2030–31.

Action:

Forecast whether salary increases will push you into a higher band

Check child benefit exposure

Consider pension contributions to reduce taxable income

3. Review property valuations if your home is near £2m+

Why: A new surcharge applies to properties above £2m.

Action:

Obtain an updated valuation

Stress-test holding costs for 2028 onwards

Consider future gifting, trust planning or restructuring of second homes

4. Update your Will and Letter of Wishes

Why: Tax baselines have shifted, and will shift again.

Action:

Revisit executors, guardians and trustees

Ensure asset distribution remains tax-efficient

Update guidance on digital assets and investment accounts

5. Audit your liquidity

Why: Higher taxes + property surcharges = more cash needed.

Action:

Check whether your estate has enough liquid assets to handle rising taxes

Review protection policies and life cover

Plan for future IHT liabilities while rules remain unchanged

6. Strengthen documentation for trusts or international structures

Why: HMRC focus on provenance and intent is increasing.

Action:

Update trust deeds, investment rationale and distribution memos

Reconfirm settlor intent and purpose

Ensure valuations are up-to-date

FOR BUSINESS OWNERS & ENTREPRENEURS

1. Revisit your remuneration strategy

Why: Dividend tax has risen by 2%.

Action:

Compare the tax cost of salary vs dividends vs pension contributions

Explore employer pension contributions to reduce higher-rate exposure

Reassess director loan strategies

2. Model the impact of threshold freezes on drawings

Why: More business owners will hit higher rates without real income growth.

Action:

Project your drawings over the next five years

Review whether profit extraction triggers the 60% effective band

Consider profit deferral or alternative extraction methods

3. Stress-test eligibility for Business Property Relief

Why: Relief remains available but under far tighter scrutiny.

Action:

Confirm your company remains a trading business (not investment-heavy)

Ensure partnership/shareholder agreements reflect operational reality

Maintain evidence: minutes, strategy documents, valuations

4. Review property held within SPVs or FICs

Why: High-value properties face new surcharges.

Action:

Revalue all properties >£2m

Project annual surcharge costs post-2028

Consider restructuring, gifting or refinancing

5. Re-evaluate exit strategy timing

Why: No new entrepreneur incentives, but rising taxes elsewhere.

Action:

Model CGT outcomes under various scenarios

Weigh phased exits vs full disposals

If planning a sale in 2026–27, prepare early: financials, valuations, legal position

6. Strengthen compliance and governance

Why: Enforcement and transparency are increasing.

Action:

Update company registers, minutes and internal processes

Keep robust evidence of business activity for relief claims

Review international or cross-border structures