Women are holding more wealth than ever before, yet many continue to navigate complex financial and legal systems without the education needed to fully understand them. As women’s wealth grows, so do the risks hidden within investment structures, legal agreements, property ownership, and long-term planning decisions. This piece explores why financial and legal education for women wealth holders is now essential infrastructure, shaping outcomes around control, protection, and intergenerational wealth, and we invite you to read, reflect, and share your perspective.

Read MoreIn prime property markets, finance is rarely straightforward. For high-net-worth individuals, wealth is often international, illiquid, and held across layered structures that sit far beyond the reach of conventional mortgage models. This article explores how bespoke property finance works at the upper end of the market, where lending is shaped around global assets, future liquidity events, and long-term wealth strategy rather than salary multiples. From asset-backed lending to cross-border structuring, it offers a clear view of how sophisticated borrowers navigate property acquisition in an increasingly complex world.

Read MoreOrganising your finances in 2026 is less a matter of discipline than of design. Over time, money has become more fragmented: accounts opened for specific moments, pensions accumulated across careers, investments spread across platforms. The result is rarely overt disorder, but a lingering lack of clarity and the sense that things are broadly fine, yet never fully in view. That uncertainty carries a cost. Financial organisation, in this context, is not about doing more, but about creating systems that make it easier to see what exists, understand what it is for, and respond calmly when circumstances change. Here’s our guide to getting your finances in order for 2026.

Read MoreWomen are now one of the fastest-growing economic forces globally, quietly reshaping how wealth is earned, controlled and passed on. Once positioned at the margins of financial decision-making, women are expected to hold nearly half of private wealth within the next decade, changing not only ownership, but the purpose and direction of capital itself. Join us as we explore the historical context behind that shift, the gaps that persist, and why the rise of women’s wealth may prove one of the most significant, and transformative, economic developments of our time.

Read MoreInheritance tax has entered a decisive turning point. In the wake of the recent Budget, long-standing assumptions about pensions, property, and legacy are being rewritten, reshaping how families plan across generations. In this Essential Series conversation, Rose Macfarlane, Partner at Irwin Mitchell, explores what the reforms really mean in practice, from the new caps on business and agricultural relief to the unexpected inclusion of pensions, and why the window for strategic action is narrower than many realise.

Read MoreThe equestrian world is a place where passion, heritage and high-performance meet, but behind the elegance of the sport lies a landscape shaped by complex legal, tax and planning considerations. From international movements of high-value horses to structuring equestrian businesses and safeguarding family estates, the sector demands specialist guidance. In this feature, we spotlight Forsters’ unparalleled expertise across the full equestrian ecosystem, offering insight into the issues that matter most to riders, owners, investors, and families building a life around the sport they love.

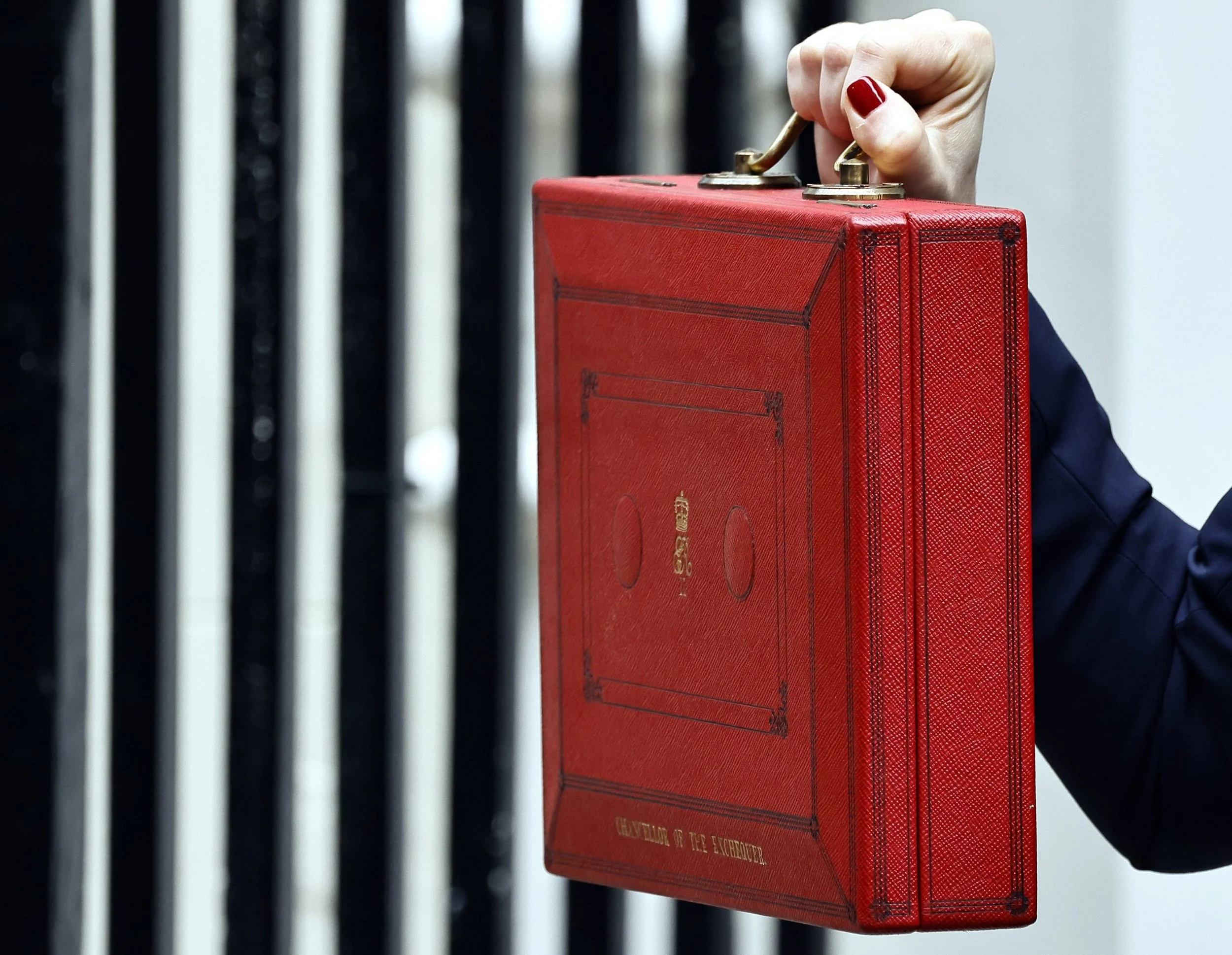

Read MoreThe Autumn Budget delivered today has reshaped the fiscal landscape with a clarity that can no longer be ignored. For the first time in years, the government has moved decisively on wealth, property and asset-based income, signalling a new era of higher taxation, stricter compliance, and reduced flexibility for families with significant holdings. Against a backdrop of global volatility and domestic pressure for revenue stability, the measures unveiled mark the beginning of a multi-year recalibration of how wealth is taxed, structured and transferred in the UK. For private-client families, entrepreneurs and cross-border households, the question is no longer if the rules will shift, but how quickly, and how prepared you are when they do.

Read MoreAs the FSCS raises its deposit protection limit from £85,000 to £100,000 on 1 December, many savers are asking what this change truly means, not just technically, but strategically. In this piece, we unpack why the increase is happening now, how the rules work in practice, and the risks clients should still be conscious of in a volatile market. From banking licences to temporary high balances, concentration risk to cash-rate complacency, this article offers a clear, calm guide to navigating cash protection with confidence in an increasingly uncertain financial landscape.

Read MoreBorn in a 17th-century coffee house where merchants met to insure ships and cargo, Lloyd’s of London has grown into the world’s most renowned insurance marketplace, underwriting everything from art collections and cyber risks to natural catastrophes. Yet behind its tradition lies a modern investment opportunity that’s quietly attracting a new generation of sophisticated investors. We spoke with Kate Tongue and Marnie Hunter of Argenta Private Capital to reveal how Lloyd’s offers diversification, inheritance tax advantages, and enduring appeal in an increasingly automated financial world.

Read MoreThe British property market is entering a period of realignment. After years of volatility, a wave of reforms, from the Leasehold and Freehold Reform Act to new rental protections and digital transparency rules, is reshaping how homes are owned, bought, and sold. We explore the forces driving these changes, what they signal for buyers, landlords, and investors, and why 2025 may mark the beginning of a more transparent, accountable era for UK property.

Read MoreFor the first time in half a decade, the FTSE 100, the UK’s flagship stock market index, has hit record territory.

The headlines call it a “five-year high.” Investors are celebrating. Politicians are quoting it.

But behind the numbers lies a more interesting truth: this isn’t a boom built on hype, but a quiet re-rating of Britain’s most global companies; and a signal that value, yield, and patience are back in fashion. We unpack what the FTSE 100 really measures, why it’s rising now, and what this moment reveals about the next era of wealth creation.

From property and pensions to inheritance and tax filings, US–UK connected clients must navigate two of the world’s most complex systems. We spoke with Amy Hill and Swaati Osborne of LGT Wealth Management US to explore how US-UK Connected families can avoid costly missteps and embrace the opportunities of a transatlantic life.

Read MoreIn an era ruled by intangible digits and blockchain cryptography, gold’s timeless allure feels almost archaic. As policy uncertainty festers, inflation concerns linger, and central banks wobble under geopolitical pressures, gold not only retains its shine but is soaring to new heights. Its value today is not merely monetary; it reflects deeper anxieties and strategic recalibrations shaping global power. In this guide we share the historical, political and investment context of the power of gold.

Read MoreIn April 2025, the UK abolished the longstanding non-dom tax regime, extending inheritance tax (IHT) to encompass global assets of UK residents—marking a seismic shift for high-net-worth individuals. Now, amid mounting concerns over an exodus of affluent non-doms and potential damage to the UK’s competitiveness, Chancellor Rachel Reeves is reportedly revisiting this policy. Join us as Hunters Law unpack the implications of this possible U-turn, its impact on trust structures and global tax planning, and what strategic adjustments may be necessary to preserve wealth while maintaining legal resilience.

Read MoreFor a rising generation, sudden wealth, whether born from viral success, entrepreneurial ventures, or unexpected opportunity, can transform lives overnight. Yet with rapid financial gain comes heightened exposure to risk: legal complexities, tax burdens, and personal vulnerability. Expert professional advice is therefore not a luxury, but a necessity, ensuring that fleeting fortune is carefully safeguarded, thoughtfully managed, and translated into lasting prosperity. We spoke with Hunters Law to explore what vulnerability looks like for those affected by sudden wealth.

Read MoreDividing pensions on divorce is one of the most overlooked, yet most critical, aspects of financial settlement. While homes and savings often take centre stage, pensions can quietly hold more value than any other asset, shaping your security for decades to come. This guide distils the complexities into clear, practical steps, helping you understand your rights, the options available, and how to protect your future. Whether you are negotiating directly, working with a mediator, or preparing for court, this resource will equip you with the knowledge to make informed, confident decisions.

Read MoreThe UK property market remains one of the world’s most desirable, yet few realise just how complex the tax and legal landscape has become. From SDLT surcharges to inheritance tax traps, the difference between a simple purchase and a sustainable legacy often lies in the structuring. For UK and non-UK residents alike, the right approach can determine whether a townhouse becomes a family asset or a tax burden. Our latest guide unpacks the rules, reliefs, and risks — with scenarios showing how high-net-worth families can optimise for efficiency, succession, and resilience.

Read MoreLast month, Irwin Mitchell’s Private Client Advisory team published a major new report: The Inheritance Tax Revolution: Regional Insights and What’s Next for UK Estates. Based on a Freedom of Information request to HMRC, the report analyses over 177,000 inheritance tax (IHT) estates across all 121 UK postcode areas. The findings are striking and point to a growing number of families who will be affected by IHT in the coming years. With thresholds frozen and property values rising, the landscape of inheritance is shifting fast. This report offers vital insight into who’s most at risk—and what steps families should be considering now.

Read MoreOne of the biggest challenges facing young professionals today is saving for a home—despite earning well, many still struggle to afford that all-important deposit. As a result, financial support from family members is becoming increasingly common, with not just parents but also grandparents, great-aunts, and uncles stepping in to help first-time buyers get on the property ladder. In this guide, we explore the financial, legal, and tax implications of family-funded house deposits—offering essential guidance on how to structure financial support wisely and avoid common pitfalls.

Read MoreMoving to the UK as a US expat comes with exciting opportunities—but also unique challenges. From understanding visa requirements and tax obligations to adapting to cultural differences and the UK’s healthcare system, there’s a lot to consider. Whether you're relocating for work, study, or a fresh start, this guide will help you navigate the key aspects of expat life, ensuring a smoother transition across the pond.

Read More