Prompted by Colin Farrell’s recent reflections on securing future care for his son, we caught up with Caroline Foulger, Partner at Hunters Law, to share a practical and compassionate framework for families navigating uncertainty. It introduces the idea of a support roadmap, a living document that brings clarity around care, decision-making, aspirations, and contingency planning, while emphasising open communication and regular review.

Read MoreThere is a long-standing rule in English succession law under which marriage automatically revokes an existing Will, which is increasingly out of step with modern life. We spoke with Hunters Law to explore how a provision originally intended to protect surviving spouses can, in practice, leave vulnerable individuals exposed, particularly in cases of predatory marriage, and reflect on the recent proposals for reform put forward by the Law Commission, while questioning whether changes to Wills law alone go far enough without wider safeguards.

Read MoreMoney decisions shape family life long before they appear in legal documents. Yet many families still avoid talking about inheritance, care, and long-term planning until they are forced to. Drawing on findings from the Schroders Family and Finances Report 2025, we look at why financial conversations remain difficult, where the biggest gaps in preparation sit, and how earlier, clearer planning can reduce stress, protect relationships, and give families more choice over time.

Read MoreCohabiting couples are the fastest-growing family type in the UK, yet the law still treats them, on separation, as if they were strangers. In a forthright conversation with Olivia Piercy, Partner at Hunters Law LLP and a recognised advocate for victim-survivors of domestic abuse, we explored why the system fails families, what reform should look like, and the practical steps you can take today to protect yourself and your children.

Read MoreDivorce is rarely a single moment; it’s a series of quiet recalibrations.

It begins in the spaces between certainty and fear, when what once felt secure now feels unsustainable, and the question shifts from “Can this be saved?” to “What does a healthy ending look like?”. This guide invites a more considered conversation: one that recognises divorce as both emotional and administrative, personal and procedural. It explores how to separate with intelligence, compassion, and stability: protecting not only wealth, but wellbeing.

For a rising generation, sudden wealth, whether born from viral success, entrepreneurial ventures, or unexpected opportunity, can transform lives overnight. Yet with rapid financial gain comes heightened exposure to risk: legal complexities, tax burdens, and personal vulnerability. Expert professional advice is therefore not a luxury, but a necessity, ensuring that fleeting fortune is carefully safeguarded, thoughtfully managed, and translated into lasting prosperity. We spoke with Hunters Law to explore what vulnerability looks like for those affected by sudden wealth.

Read MoreDividing pensions on divorce is one of the most overlooked, yet most critical, aspects of financial settlement. While homes and savings often take centre stage, pensions can quietly hold more value than any other asset, shaping your security for decades to come. This guide distils the complexities into clear, practical steps, helping you understand your rights, the options available, and how to protect your future. Whether you are negotiating directly, working with a mediator, or preparing for court, this resource will equip you with the knowledge to make informed, confident decisions.

Read MoreDeciding to end a marriage or civil partnership is one of the most significant legal, financial and emotional transitions in life. While it is always an emotional journey, understanding the legal process can provide structure and clarity at a time that can otherwise feel overwhelming. Since the Divorce, Dissolution and Separation Act 2020, which came into force in April 2022, the process has been simplified, removing the need to assign blame. Today, the only requirement is to confirm that the marriage or partnership has irretrievably broken down. Below, we set out the key stages of the legal process and what you can expect in terms of costs and timing.

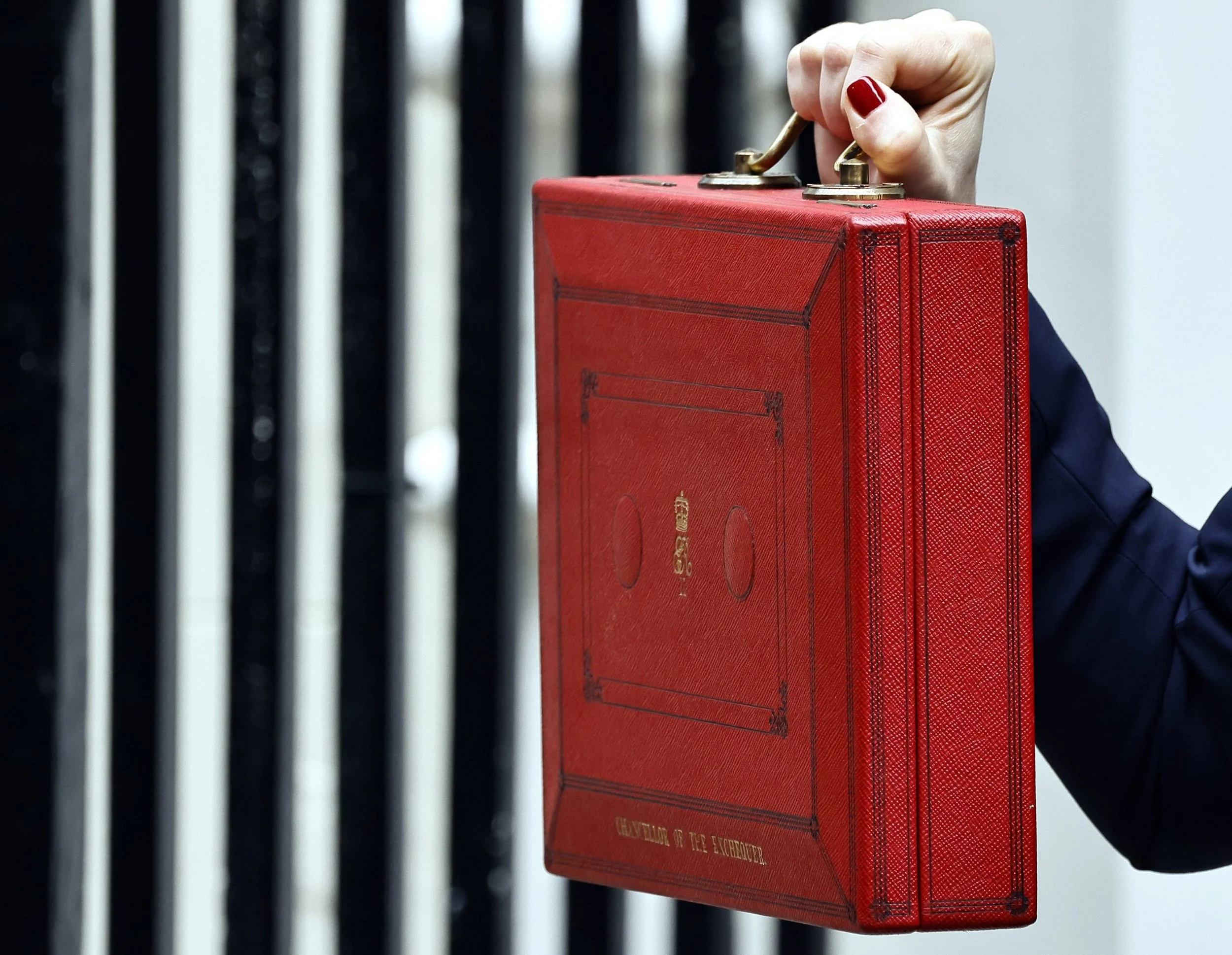

Read MoreLast month, Irwin Mitchell’s Private Client Advisory team published a major new report: The Inheritance Tax Revolution: Regional Insights and What’s Next for UK Estates. Based on a Freedom of Information request to HMRC, the report analyses over 177,000 inheritance tax (IHT) estates across all 121 UK postcode areas. The findings are striking and point to a growing number of families who will be affected by IHT in the coming years. With thresholds frozen and property values rising, the landscape of inheritance is shifting fast. This report offers vital insight into who’s most at risk—and what steps families should be considering now.

Read MoreAs modern family structures evolve, the legal landscape struggles to keep pace. In this insightful exploration, family law Partner Amy Rowe of Hunters Law shares essential guidance on navigating the legal, emotional, and practical realities of alternative paths to parenthood—from co-parenting and donor conception to surrogacy in the UK and abroad. Drawing on both her professional expertise and her own IVF journey, Rowe offers clarity, compassion, and critical advice for anyone considering building a family outside traditional norms. A must-read for prospective parents, legal professionals, and anyone interested in the future of family.

Read MoreIn the realm of wealth stewardship, there are few concepts as elegant as the Acceptance in Lieu (AIL) scheme — a little-known but powerful way to balance inheritance tax liabilities with cultural legacy. For those who hold or manage national heritage assets, AIL presents a unique opportunity: preserve something beautiful for the public good while also protecting your estate’s value. We spoke with Rebecca Bion of Forsters Law to find out how this works — and why it may be an inspired tool for those thinking about wealth, impact, and legacy through a more expansive lens.

Read MoreDelays in obtaining public sector pension valuations—particularly from the Teachers’ Pension Scheme—are causing significant challenges in divorce proceedings. With legal, financial, and emotional implications for separating couples, and especially for vulnerable individuals, the issue has reached a tipping point. As the NASUWT union launches legal action on behalf of its members, family lawyers and clients alike are watching closely. We spoke with Jo Carr-West, Family Partner at Hunters Law, about why this matters, and what can be done in the meantime.

Read MoreThe UK has introduced the Electronic Travel Authorisation (ETA) scheme, similar to the US ESTA, requiring visitors from visa-exempt countries to obtain approval before travelling. While this adds a minor administrative step for most, it poses challenges for those with criminal convictions or adverse immigration histories, potentially necessitating a complex visitor visa application. In this Expert Guide we share what this means for you and how to prepare.

Read MorePlanning for the future is essential, but inheritance disputes and questions about mental capacity can complicate even the best-laid plans. Whether you're concerned about a loved one's ability to make a valid will or worried about being left out of an estate, understanding the legal framework is crucial. In this guide, we’ll explore what mental capacity means in estate planning, why succession disputes happen, and how you can take proactive steps to protect your rights and prevent conflicts.

Read MoreManaging the estate of a loved one who has lost mental capacity can be a complex and emotional process. When someone is unable to make or amend their will, the Court of Protection steps in to ensure their estate is handled fairly and in their best interests. This guide explores the process of applying for a Statutory Will, the legal safeguards in place, and how to recognise and prevent financial abuse of vulnerable individuals. By understanding these key aspects, families and professionals can take proactive steps to protect assets, ensure fairness, and uphold the true wishes of those who can no longer express them fully.

Read MoreOne of the biggest challenges facing young professionals today is saving for a home—despite earning well, many still struggle to afford that all-important deposit. As a result, financial support from family members is becoming increasingly common, with not just parents but also grandparents, great-aunts, and uncles stepping in to help first-time buyers get on the property ladder. In this guide, we explore the financial, legal, and tax implications of family-funded house deposits—offering essential guidance on how to structure financial support wisely and avoid common pitfalls.

Read MoreIn March 2024, the UK government announced that they intended to make changes to the way in which UK taxes apply to those who have a non-UK connection, such as non-UK domiciled people (non-doms). On 30 October 2024, the government confirmed that changes would go ahead and produced a detailed note and draft legislation that provide much more detail. This note, in partnership with Irwin Mitchell, summarises the changes. The new rules relate only to tax – domicile will continue to exist as a concept that will be important when looking at, for example, succession laws and family law matters.

Read MoreDivorce is a major life change that affects every part of a person's life. It can be a difficult and emotional journey, especially when it comes to money. Women, in particular, can face unique challenges when it comes to divorce and money.

Read MoreWhat are the potential legal implications of the menopause? What can employers do to support employees. What steps can employees can take if they consider they are being treated less favourably due to their symptoms? Find out here as we are joined by Catherine Hawkes, employment solicitor at Royds Withy King.

Read More