The story of wealth in 2026 is not being written in headlines, but in the slow recalibration of markets, materials and assumptions. We welcomed Altus investment Management to share their Market Outlook for 2026, and to explore why easy conditions are giving way to a more exacting environment, and what that means for women thinking seriously about stewardship, resilience and the future of their capital.

Read MoreWomen are holding more wealth than ever before, yet many continue to navigate complex financial and legal systems without the education needed to fully understand them. As women’s wealth grows, so do the risks hidden within investment structures, legal agreements, property ownership, and long-term planning decisions. This piece explores why financial and legal education for women wealth holders is now essential infrastructure, shaping outcomes around control, protection, and intergenerational wealth, and we invite you to read, reflect, and share your perspective.

Read MoreBehind every deal lies the question: what if something goes wrong? Buyers want certainty, sellers want a clean exit: warranties and indemnities are the levers that help bridge that divide. From litigation risk to undisclosed liabilities, these contractual promises shape the fairness and viability of any transaction. Forsters’ Corporate team explores how they work in practice, and why they remain central to business sales of every size.

Read MoreIn prime property markets, finance is rarely straightforward. For high-net-worth individuals, wealth is often international, illiquid, and held across layered structures that sit far beyond the reach of conventional mortgage models. This article explores how bespoke property finance works at the upper end of the market, where lending is shaped around global assets, future liquidity events, and long-term wealth strategy rather than salary multiples. From asset-backed lending to cross-border structuring, it offers a clear view of how sophisticated borrowers navigate property acquisition in an increasingly complex world.

Read MorePrompted by Colin Farrell’s recent reflections on securing future care for his son, we caught up with Caroline Foulger, Partner at Hunters Law, to share a practical and compassionate framework for families navigating uncertainty. It introduces the idea of a support roadmap, a living document that brings clarity around care, decision-making, aspirations, and contingency planning, while emphasising open communication and regular review.

Read MoreThere is a long-standing rule in English succession law under which marriage automatically revokes an existing Will, which is increasingly out of step with modern life. We spoke with Hunters Law to explore how a provision originally intended to protect surviving spouses can, in practice, leave vulnerable individuals exposed, particularly in cases of predatory marriage, and reflect on the recent proposals for reform put forward by the Law Commission, while questioning whether changes to Wills law alone go far enough without wider safeguards.

Read MoreMoney decisions shape family life long before they appear in legal documents. Yet many families still avoid talking about inheritance, care, and long-term planning until they are forced to. Drawing on findings from the Schroders Family and Finances Report 2025, we look at why financial conversations remain difficult, where the biggest gaps in preparation sit, and how earlier, clearer planning can reduce stress, protect relationships, and give families more choice over time.

Read MoreOrganising your finances in 2026 is less a matter of discipline than of design. Over time, money has become more fragmented: accounts opened for specific moments, pensions accumulated across careers, investments spread across platforms. The result is rarely overt disorder, but a lingering lack of clarity and the sense that things are broadly fine, yet never fully in view. That uncertainty carries a cost. Financial organisation, in this context, is not about doing more, but about creating systems that make it easier to see what exists, understand what it is for, and respond calmly when circumstances change. Here’s our guide to getting your finances in order for 2026.

Read MoreWomen are now one of the fastest-growing economic forces globally, quietly reshaping how wealth is earned, controlled and passed on. Once positioned at the margins of financial decision-making, women are expected to hold nearly half of private wealth within the next decade, changing not only ownership, but the purpose and direction of capital itself. Join us as we explore the historical context behind that shift, the gaps that persist, and why the rise of women’s wealth may prove one of the most significant, and transformative, economic developments of our time.

Read MoreIn a world obsessed with bunkers, biometrics and worst-case AI scenarios, what does it actually mean to live a secure life? In this Essential Series conversation, Kate Bright, CEO and founder of Umbra International Group, reframes security not as guards, gates and gadgets, but as a human, holistic “secure lifestyle” built on Four Pillars: physical, digital, reputational and emotional health. From community WhatsApp groups and Google alerts to cognitive resilience and next-gen online safety, she explores how to move from reactive fear to proactive, everyday peace of mind, and why the real work of security now starts with a conversation, not a crisis.

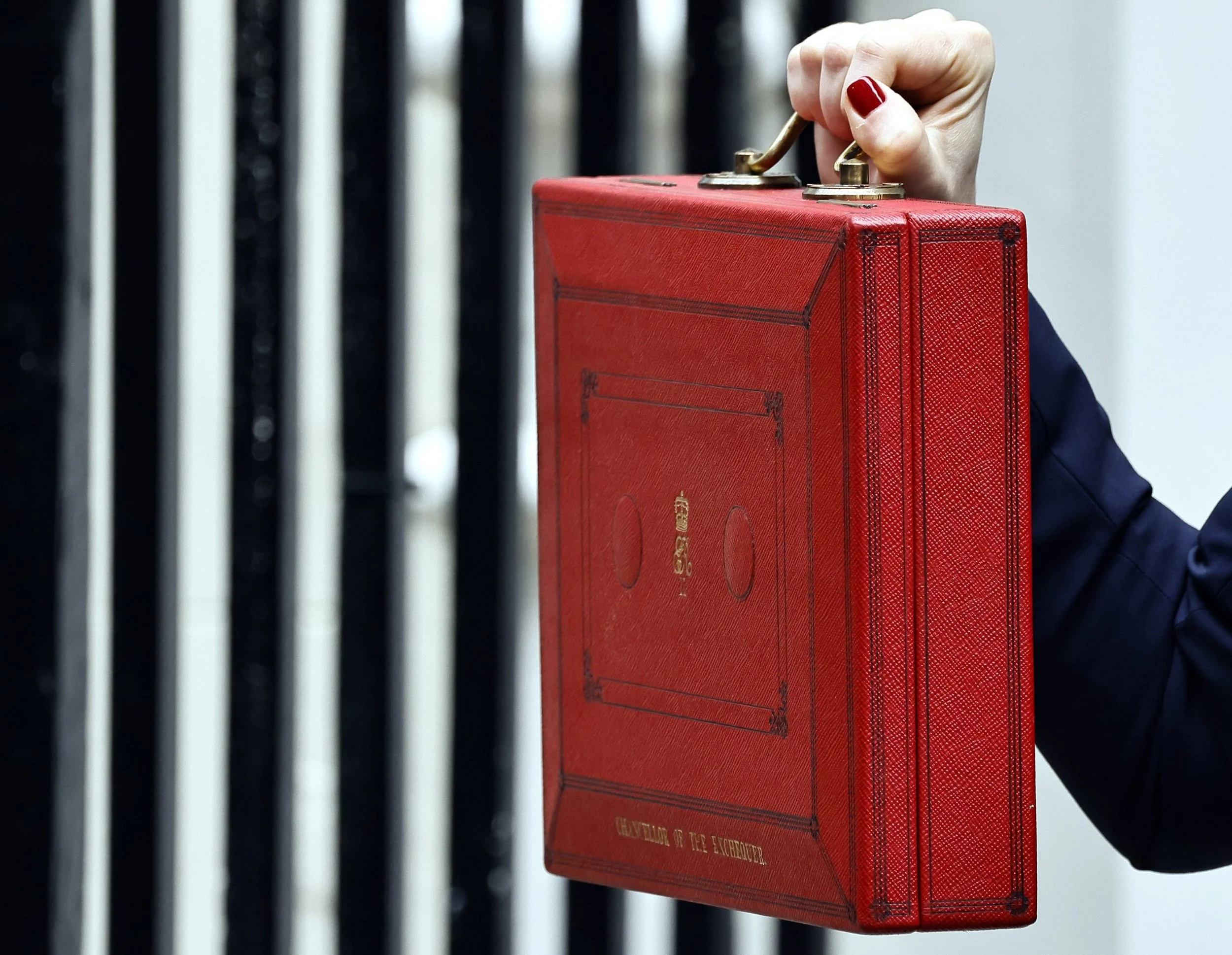

Read MoreInheritance tax has entered a decisive turning point. In the wake of the recent Budget, long-standing assumptions about pensions, property, and legacy are being rewritten, reshaping how families plan across generations. In this Essential Series conversation, Rose Macfarlane, Partner at Irwin Mitchell, explores what the reforms really mean in practice, from the new caps on business and agricultural relief to the unexpected inclusion of pensions, and why the window for strategic action is narrower than many realise.

Read MoreThe equestrian world is a place where passion, heritage and high-performance meet, but behind the elegance of the sport lies a landscape shaped by complex legal, tax and planning considerations. From international movements of high-value horses to structuring equestrian businesses and safeguarding family estates, the sector demands specialist guidance. In this feature, we spotlight Forsters’ unparalleled expertise across the full equestrian ecosystem, offering insight into the issues that matter most to riders, owners, investors, and families building a life around the sport they love.

Read MoreThe Autumn Budget delivered today has reshaped the fiscal landscape with a clarity that can no longer be ignored. For the first time in years, the government has moved decisively on wealth, property and asset-based income, signalling a new era of higher taxation, stricter compliance, and reduced flexibility for families with significant holdings. Against a backdrop of global volatility and domestic pressure for revenue stability, the measures unveiled mark the beginning of a multi-year recalibration of how wealth is taxed, structured and transferred in the UK. For private-client families, entrepreneurs and cross-border households, the question is no longer if the rules will shift, but how quickly, and how prepared you are when they do.

Read MoreAs the FSCS raises its deposit protection limit from £85,000 to £100,000 on 1 December, many savers are asking what this change truly means, not just technically, but strategically. In this piece, we unpack why the increase is happening now, how the rules work in practice, and the risks clients should still be conscious of in a volatile market. From banking licences to temporary high balances, concentration risk to cash-rate complacency, this article offers a clear, calm guide to navigating cash protection with confidence in an increasingly uncertain financial landscape.

Read MoreBorn in a 17th-century coffee house where merchants met to insure ships and cargo, Lloyd’s of London has grown into the world’s most renowned insurance marketplace, underwriting everything from art collections and cyber risks to natural catastrophes. Yet behind its tradition lies a modern investment opportunity that’s quietly attracting a new generation of sophisticated investors. We spoke with Kate Tongue and Marnie Hunter of Argenta Private Capital to reveal how Lloyd’s offers diversification, inheritance tax advantages, and enduring appeal in an increasingly automated financial world.

Read MoreIn The Art of Enough series, we explore what happens when ambition meets contentment, and how women can define wealth and wellness on their own terms. In this conversation, entrepreneur and polar expedition leader Heather Thorkelson shares how she built businesses that sustain a life rather than consume it. From leaving the corporate world to founding Polar Tracks Expeditions and Minimal Impact Cruises, Heather’s story is one of courage, clarity, and conscious growth. Together, we unpack how to find freedom in sufficiency, peace in purpose, and the quiet power of knowing what is truly enough.

Read MoreAfter years in gold’s shadow, silver is having its moment. In recent months, demand for the metal has accelerated across every channel, from physical bars and coins to ETFs and industrial applications, driving prices to multi-year highs and sparking whispers of shortage. What began as a technical commodity story has evolved into a mirror of our age: a world caught between transition and uncertainty, seeking both growth and security.

Read MoreCohabiting couples are the fastest-growing family type in the UK, yet the law still treats them, on separation, as if they were strangers. In a forthright conversation with Olivia Piercy, Partner at Hunters Law LLP and a recognised advocate for victim-survivors of domestic abuse, we explored why the system fails families, what reform should look like, and the practical steps you can take today to protect yourself and your children.

Read MoreDivorce is rarely a single moment; it’s a series of quiet recalibrations.

It begins in the spaces between certainty and fear, when what once felt secure now feels unsustainable, and the question shifts from “Can this be saved?” to “What does a healthy ending look like?”. This guide invites a more considered conversation: one that recognises divorce as both emotional and administrative, personal and procedural. It explores how to separate with intelligence, compassion, and stability: protecting not only wealth, but wellbeing.

The British property market is entering a period of realignment. After years of volatility, a wave of reforms, from the Leasehold and Freehold Reform Act to new rental protections and digital transparency rules, is reshaping how homes are owned, bought, and sold. We explore the forces driving these changes, what they signal for buyers, landlords, and investors, and why 2025 may mark the beginning of a more transparent, accountable era for UK property.

Read More